As climate change shifts from an environmental to an economic disruptor, green finance is no longer a “nice to have”. India, like many emerging economies, is rapidly greening its capital flows, responding to global climate mandates and domestic sustainability goals.

From issuing sovereign green bonds to pushing ESG norms. India’s Financial ecosystem is evolving, signaling a major shift in how capital is raised, allocated, and reported – balancing growth with sustainability.

The Global Push and India’s Catch-Up

India accounts for nearly 7% of global carbon emissions, but attracts only 3% of global green capital flows. In FY 2021–22, India mobilized USD 50 billion (INR 3.7 lakh crore) in green finance, while global finance flows reached USD 1.46 trillion in the same period.

Despite strong policy momentum, India’s capital inflows remain modest relative to its climate risk and investment needs.

Key sector driving investment: Renewable Energy, EV infrastructure, and Green Buildings.

Source: Climate Policy Initiative

A Real-Time Shift: Sovereign Green Bonds Spark Momentum

In January 2023, India issued its first tranche of sovereign green bonds worth ₹8,000 Cr. Proceeds were used to fund clean transport, solar, and afforestation projects.

Sovereign Green Bond vs Traditional Bond

|

Feature |

Green Bond (India) |

Conventional Bond |

|---|---|---|

|

Yield (10-yr) |

7.29% |

7.38% |

|

Use of Proceeds |

ESG-linked Projects |

General Budget |

|

Transparency Requirement |

High |

Moderate |

Source: Geeksforgeeks

The oversubscription of this issuance has led to increased institutional interest and a revaluation of green debt instruments.

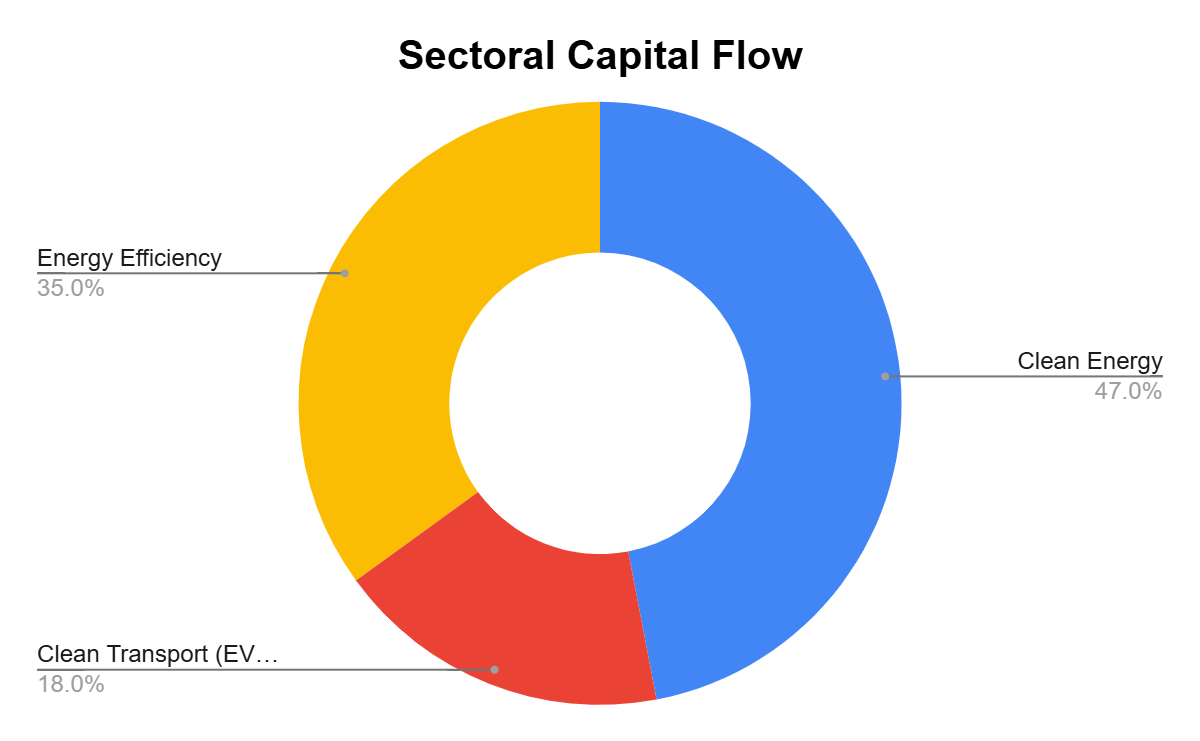

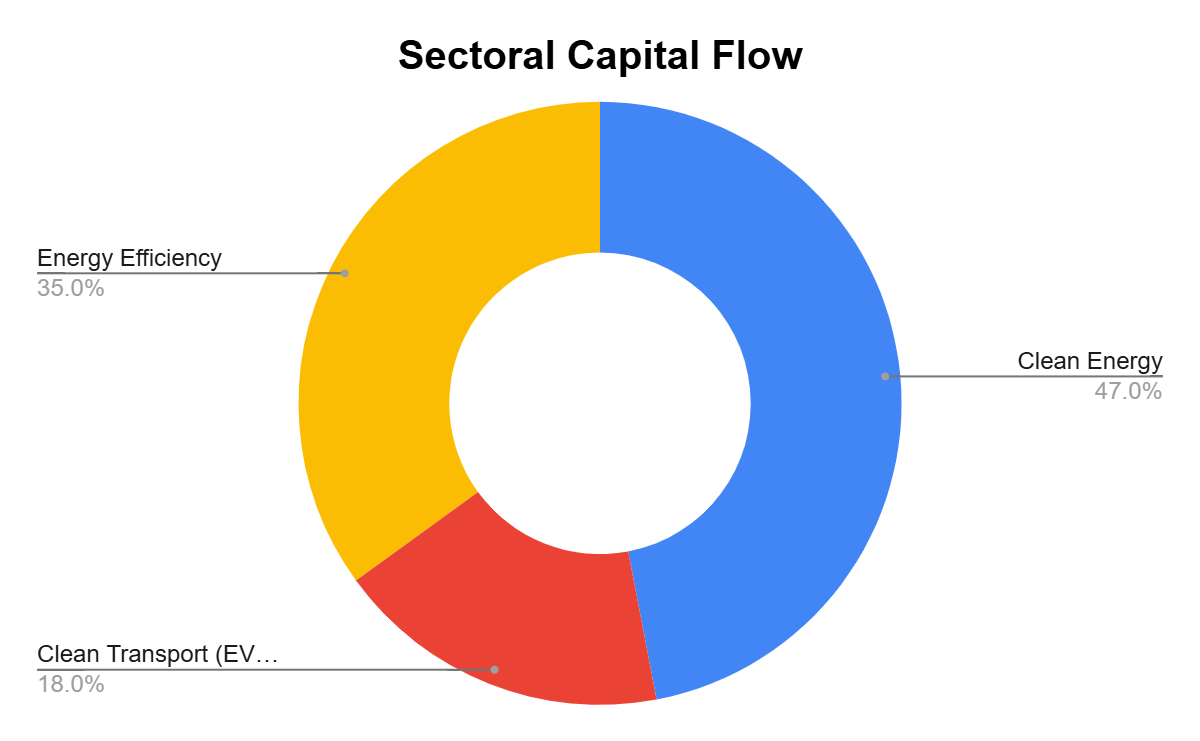

Sectoral Capital Flow Snapshot (2023)

Here’s a snapshot of how green finance is currently allocated across sectors:

Note: Despite the volume, green finance remains concentrated. Broader sectoral participation is essential.

Source:CPI

What It Means for Borrowers and Businesses

Green finance doesn’t just benefit the environment — it improves access to capital and lowers borrowing costs.

For example, a solar rooftop loan at 6.75% (vs a market rate of 9%) can save a mid-sized factory ₹12–15 lakhs over 10 years. These concessional terms are often enabled by:

- Support from Multilateral Development Banks (MDBs) like the ADB and World Bank

- ESG-linked covenants or first-loss guarantees

Investor Returns in a Green Market

Green financial instruments are increasingly competitive on returns — especially when adjusted for risk and volatility.

Investment Product Comparison (India, 2023)

|

Asset Class |

Avg Return (3 Yr)/ CAGR |

Risk |

Green/ESG Sensitivity |

|---|---|---|---|

|

ESG Mutual Funds |

12–16% |

Moderate |

High |

|

Green Bonds (Gilt) |

6.8–7.2% |

Low |

Very High |

|

Fixed Deposits |

5.5–6.5% |

Low |

None |

|

Climate Tech Startups |

25–30% CAGR |

High |

Very High |

ESG Sensitivity shows how closely the investment aligns with sustainability and impact goals.

Sources: Valueresearch, ET, GlobalNewswire

Strategy Recommendations for Stakeholders

- Retail: Allocate 10–15% to ESG funds; stagger FD investments.

- SMEs: Tap concessional green loans; retrofit for energy efficiency.

- Banks/NBFCs: Build ESG scorecards; partner with SIDBI and green funds.

- Startups: Showcase impact; leverage ONDC and carbon credits.

- Corporates: Issue ESG bonds; link loans to sustainability KPIs.

Potential Outcomes of Growing Green Finance

- More green bond issuance: lowers borrowing costs for clean infrastructure.

- Mandatory ESG disclosures: increase investor confidence.

- Inclusion in green taxonomies: improves access to concessional capital.

- Boost in climate tech: creates jobs and attracts investment.

Looking Ahead: Opportunities and Caution

As India chases its net-zero 2070 goal, it needs over $10 trillion in green investments.

Current capital mobilization is a fraction; scaling will need:

- Broader retail investor participation.

- Clear SEBI ESG rating norms to prevent greenwashing.

- Use of AI and tech for impact measurement and reporting

Green finance isn’t just about saving the planet — it’s about redefining returns in an era where sustainability will increasingly dictate capital efficiency.

Are you positioned to grow your wealth as India decarbonizes?