Financial model

A financial model is a set of assumptions about future business conditions that drive projections of a company’s revenue, earnings, cash flows, and balance sheet accounts.

Financial modeling is the process of creating a summary of a company’s expenses and earnings in the form of a spreadsheet that can be used to calculate the impact of a future event and it allows the decision makers to observe potential outcomes, to test scenarios to make an informed decision.

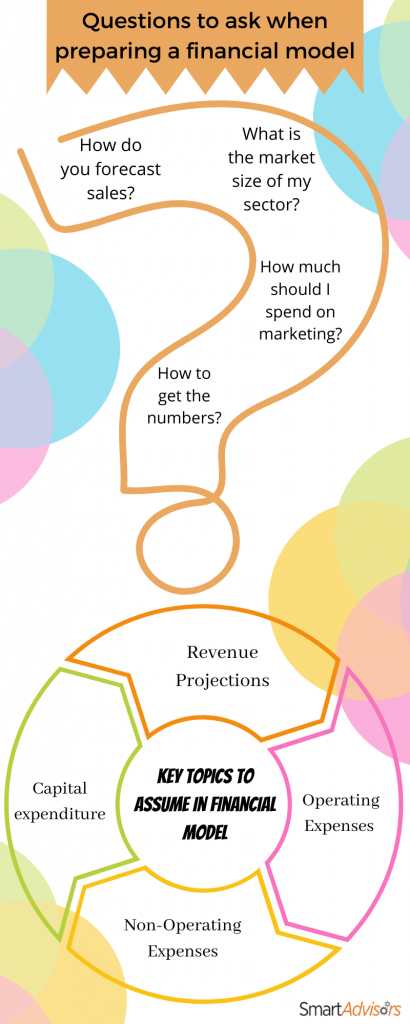

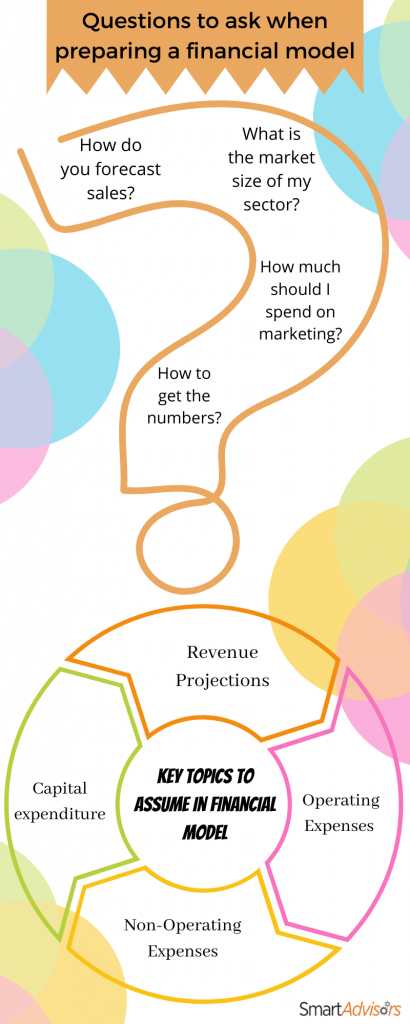

How to create the assumptions for startup financial model

The important categories that need to be covered in the assumptions are as follows:

- Economic factors – Industry growth, GDP growth, level of inflation, interest rates, etc.

- Currency rates – If International business is involved in your company.

- Changes in the applicable taxes in every market your company is serving.

- Changes in pricing/mark-up policies of the company. For the price fluctuations of the goods use a unified forecast for exchange-traded goods or raw materials.

- How to plan your budget if there is a possible expansion projects within the company – whether and when you plan to build a new factory or open a new shop.

- Other significant risk factors to the company.

- How much will your clients pay, and what will your costs to deliver it be at first, then at scale

- How many people do you need on the team to get to your first milestones

- How big is the market, and if you capture a small amount of it, do you have enough revenue to have a real business

- What are Customer Acquisition Costs and how do you model them

How to set up realistic financial projections for startups

Step 1: The projections should capture the size of the market; bigger markets lend themselves to bigger projections and estimates, higher growth, etc.

Step 2: Project growth/top-line revenue numbers, along with expenses.

Step 3: Focus on the assumptions that makes sense from the target customers point of view, are they willing to pay, and then how that impacts your margins and growth.

Step 4: Research similar companies’ business models and financial statements. For example, plenty of companies have shared their data public choose the relevant companies’ data whichever is relevant to your company and see how their financial statements changed over time.

Step 5: Do not model yourself out of a deal! If you are truly focusing on a huge market opportunity with tons of potential customers willing to pay for your product, do not be too conservative, to an extent that your projections do not look interesting to potential investors, co-founders, and employees.

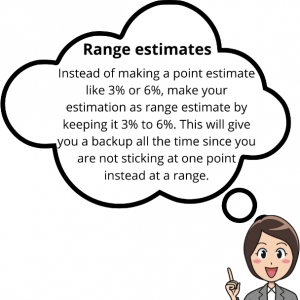

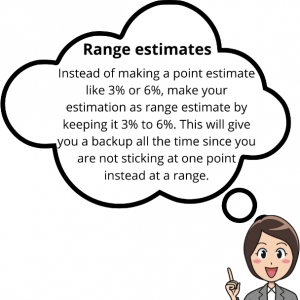

Always remember to make a financial model which is practically possible so that it will really workout. Prepare them with a backup plan always so that you will not leave out anything or stand still on the mid-way during the execution of the prepared plan.