Fintech – An overview

Fintech in India is one of the fastest-growing ecosystems. It is the third largest ecosystem in the world after US and China. Globally India has the highest adoption rate at 87% out of 64% of the global average. As of October 2022, India is home to 25 unicorns and 6,636 startups in the fintech sector. The sector has raised total funding of $34.9 Bn in the last decade. The market size of the industry is estimated to grow at a CAGR of 31% and reach $1.3 Tn by 2025, according to reports.

Lending Technology

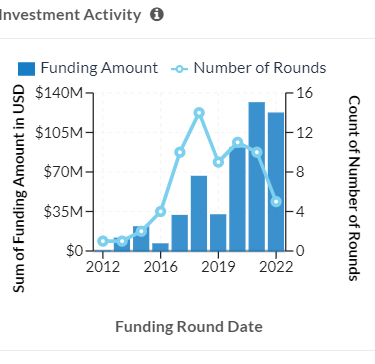

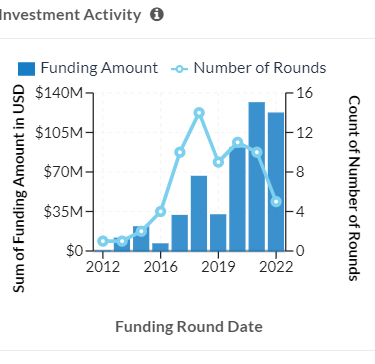

Lending tech/Digital Lending, one of the key sub-sectors of fintech has grown exponentially in the last few years. The market has grown from $9 Bn in 2012 to $110 Bn in 2019. It is also estimated to grow by $350 Bn in 2023, according to the latest reports.

This sector has raised total funding of $6.49 Bn between 2014 and Q2 2022.

Traditionally, the financial credit market was dominated by banks and NBFCs which came with a lengthy documentation process and a longer time. Moreover, the credits and loans were provided against collaterals. An unorganized credit system was also followed for personal loans without any secured documents- lent by family, community lenders, or unorganized private lenders.

Lending tech companies have recognized this to be a good target market to use tech by providing unsecured loans, lower turnaround time, and customer satisfaction. The major focus of this sector is on MSME followers and urban individual customers.

Business Model

Key Players

Risk Management

The financial sector in India has been traditionally ruled by banks and financial institutions. The convenience and speed of services were not appreciable. With the advent of technology, the sector saw rapid transformation and growth.

The intervention of the government in the sector to introduce UPI, GST, Linkage of Aadhaar cards with bank accounts, National budget program on AI, etc have shown that there is growth in the sector. However, as we have two sides to a coin, the growth comes with risks of the following regulatory oversight.

Governing Body:

Banks and financial institutions are governed by principles and regulatory frameworks. For the Indian fintech sector, there is no separate regulatory authority. At present, the sector must abide by the regulatory reforms passed by RBI, SEBI, Insurance Regulatory and Development Authority(IRDA), and Telecom Regulatory Authority of India(TRAI). All of them often pass contradictory reforms which is affecting the smooth functioning of fintech companies. Added to this are the regulatory frameworks passed by different state governments. To improvise, there should be a single central authority to regulate the reforms and guidelines for the smooth functioning of the fintech ecosystem.

Security Threats:

Fintech as a sector is reliant on the internet and technology which is exposed to security risks like fraud and money laundering, cyber security vulnerabilities, data privacy risks, and many others. To avoid such threats the regulatory rules and reforms should be made with a prime focus on national risk management given the higher rate of fintech adoption in the country.

Fintech startups can have partnerships with managed security service providers. This way they can develop and maintain a strong cybersecurity ecosystem for their product or service. Companies are already performing ethical hacking internally by themselves to know if there are any risks and threats involved. This way these companies should explore different verticals to build a credible service by evading the risks.

Managing of Documents:

Even today majority of the companies collect documents through email. They have not interlinked with any loan-originating platforms. The collection of documents this way makes it difficult for them to maintain and track the same with the customers’ profiles in the long run.

Lending platforms should create a centralized software application where all the documents of the customers can be linked to their name and loan application forms. This way it will help them in tracking the customers’ documents with respect to their profiles and tracking and knowing a customer’s financial history with the firm can be pulled over the heck of a button.

Contract management:

Contracts that are newly signed and executed are still paper-based. These physical documents need to be saved till the duration of the loan. Setting up digital contract management software might ease the process of maintaining physical contracts by eliminating the infrastructure that will be required to secure such documents. The same software can be linked to that of the central software system in case they are required based on the company’s needs.

Customer acquisition:

The conventional methods have been using third-party underwriters and credit reports to assess the potential borrowers/customers’ risk profile.

In modern times, unconventional sources like social media and other internet-based individual customer data are being used to create customer profiles and metrics. By collecting such data startups build newer credit risk models using business analytics tools. This will help companies to have more appropriate data on customers thus reducing the risk of credit loss.

Lead generation:

One of the major challenges faced by customers in approaching digital lenders is that they are not aware of the total bandwidth and eligibility criteria provided by fintech lenders.

To solve this issue the startups can set up a bot along with a prequalified system that will be automatic. The leads may know about their eligibility criteria with clarity early hands. This will generate more appropriate customers and may even increase the probability of the number of loans closed per interval.

Conclusion

The latest report published by business today on RBI has mentioned that: the RBI has constituted a Working Group on digital lending and the group has given its recommendations that aims in providing a balance between measures addressing concerns that are posed by digital evolution in financial services while ensuring the sector can reap the benefits of digital innovation.

The recommendations are around reporting, payments and settlement systems, storage of biometric data, simplification of digital products, governance, etc., to ensure financial stability, market integrity, and consumer protection. Laws around clarity on outsourcing guidelines, data privacy and protection, transparency in product design, and the ability to conduct audit trails on AI/ML-based underwriting algorithms, will bring in the much-required monitoring and governance in the segment, especially for existing non-regulated players.