ESG is a buzzword that has been floating around over the past few years, but what is it really, and what does it mean for you as a business owner? ESG stands for Environmental, Social, and Governance (ESG), and this is a set of standards that corporates need to hold themselves up to, to be considered socially conscious.

There are 3 distinct areas that corporates need to monitor:

- E – Environment: This considers aspects such as how businesses act towards the environment, for example, how they handle industrial waste, effluents, etc.; or if there is any climate neutral initiatives like clean energy being used.

- S – Social: The social aspect considers all the stakeholders in the business, including local communities, employees, vendors, clients – basically anyone who is affected by the business in any way.

- G – Governance: The governance area focuses on the management, compensations, share holder relations, internal auditing, etc.

All these are important areas for any corporate or business, irrespective of sector, to focus on. A good ESG practice by companies, showcases a good corporate culture and weeds out malpractice at various levels. While it is important for large corporates to improve on these areas, it is equally if not more important for smaller businesses to start following these practices. Starting when your business is smaller will result in a stronger ESG culture being developed.

In today’s world where financial numbers alone are not enough to brand a company “good” or “great”, the ESG metrics can make companies stand out against their peer sets. However, it is about action and not just mentioning jargon in press conferences and annual reports, with many companies appointing ‘Chief Sustainability Officers’ to ensure that ESG goals are met.

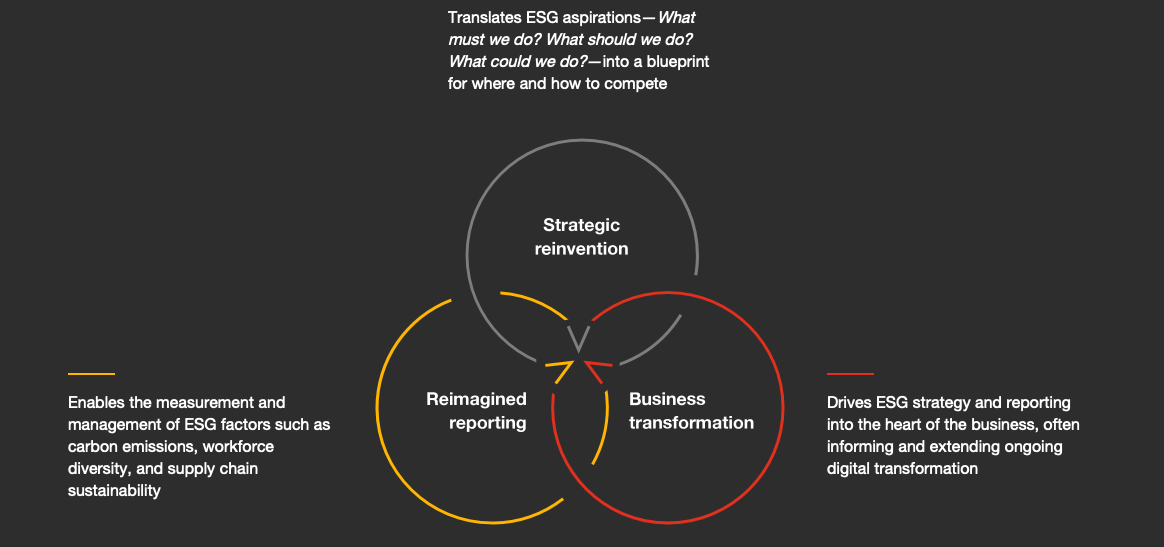

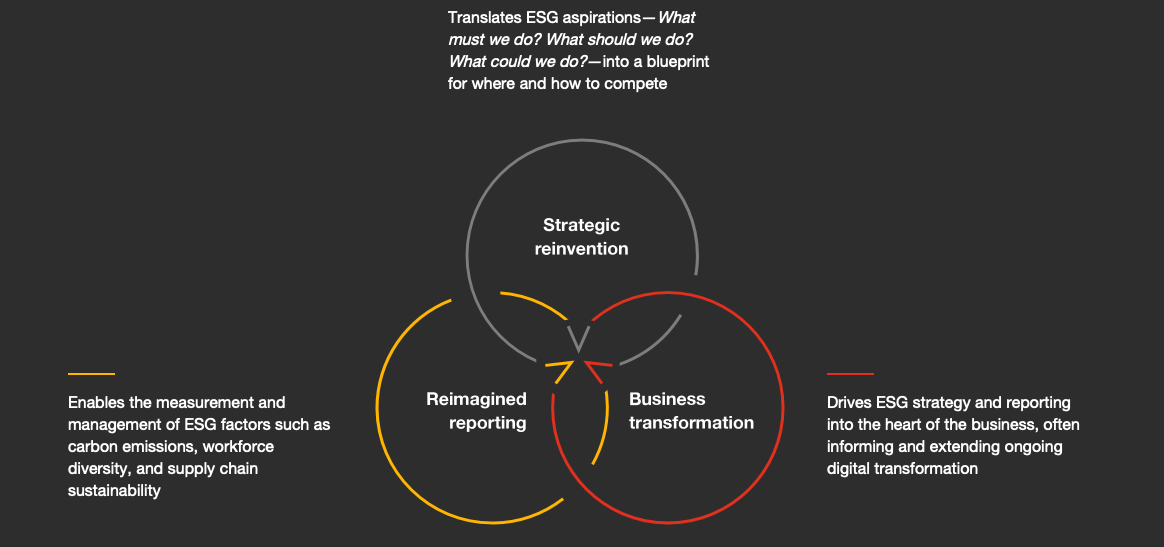

Source: PWC

E – Environment:

Climate change is real and happening faster than anticipated, and without the joint efforts of all businesses – globally, there can be no headway in reducing our carbon footprint. Actions such as increasing the usage of clean energy, afforestation, recycling waste, etc. can form part of ESG plans. The overall objective here should be to be more carbon neutral – across the company’s value chain, including suppliers.

For example, a company that is heavily dependent on logistics like ecommerce, can look at getting their vendor to convert their fleet to electric vehicles or reduce the number of truck runs, etc.

Another aspect is dealing with global warming in a more real way, meaning, over the years the weather has changed, and parts of the world are dealing with unprecedented weather. Such as floods, heatwaves, and other freak weather conditions. Companies need to make contingency plans for such eventualities to ensure continuity of work and production.

S – Social:

A strong ESG policy can help build out trust among all stakeholders – especially employees and customers. Employees want fair treatment, good pay and other benefits that are on a measurable scale with executive renumeration – a good ESG policy will take care of this and be transparent about the process. This in turn helps with employee happiness, engagement & retention.

Another area that can form part of the ‘Social’ aspect of ESG is increasing awareness about employee health and safety – both to the employees and management. The company can also ensure that its vendors (and its whole supply chain) live up to the same ESG standards it sets itself, e.g. not using child labour.

These days customers are looking for brands that have responsible values and not just the cheapest or fastest companies (e.g. organic cotton, ethical leather, etc.). A strong ESG policy, which is publicly communicated, along with regular ESG updates being publicly available, will go a long way in increasing the trust factor with potential clients. For example, a snack brand can host webinars and events to increase awareness of healthy snacking – resulting in more brand recall, while also doing public good.

G – Governance:

A lot of corporate scandals revolve around executive pay and favoritism. This aspect of ESG covers this and ensures sufficient oversight on these matters to reduce such risks. It may be a combination of board members, legal agreements, or even external consultants monitoring the board closely.

Tangible Benefits of ESG:

Revenue Growth –

- Clients trust the brand more

- Better employee utilization thanks to happier employees

Drop in Costs –

- Reduction in input costs such as electricity

- Packing costs can come down with more sustainable methods

Productivity Increase –

- Employees will be happier, resulting in better productivity

- Better talent pool will be available due to increased brand trust

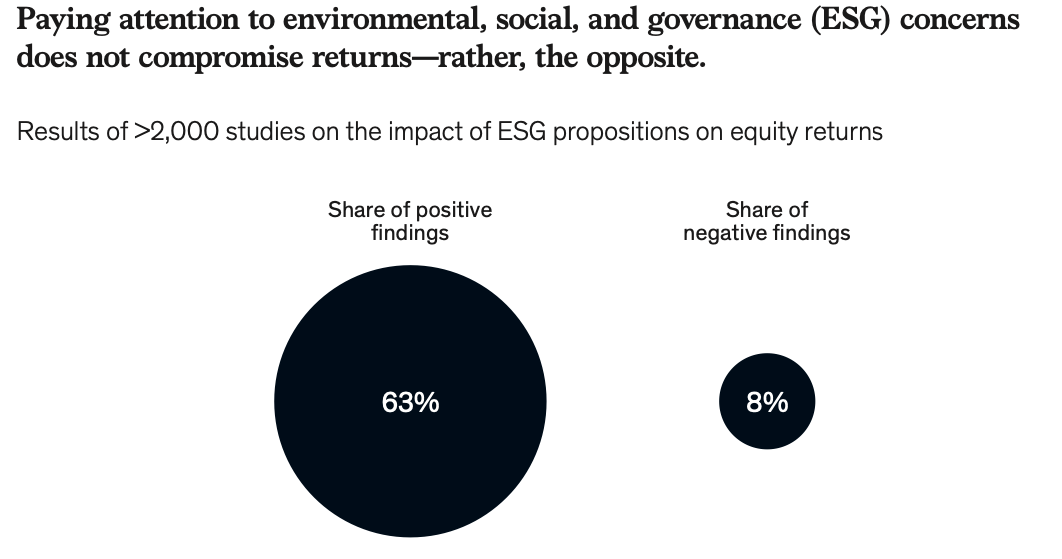

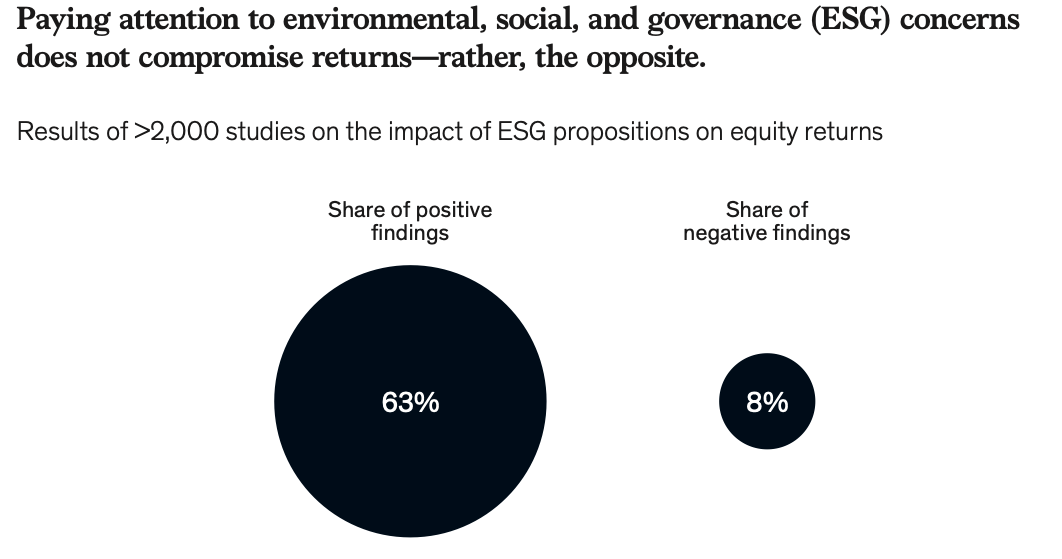

Source: Mckinsey