FinTech’s environment is evolving at lightning speed

The fintech sector is undergoing a major transformation every day. These changes are crucial because they affect every aspect of payments, money, and banking.

Most businesses suffered when the COVID-19 pandemic struck the world. The fintech industry was one of the few industries that displayed an upward trend. Due to the pandemic, the adoption of contactless payment options among customers and companies increased significantly. Additionally, during COVID-19, agency banking exploded in the financial industry. The following are the five main trends that are emerging:

1. Digital-Only Banks:

A bank that only offers services online, on mobile devices and tablets is known as a “digital-only bank.” With the aid of electronic documents, real-time data, and automated processes, it provides essential services in the simplest way possible.

In addition to being easy and comfortable for next-generation clients, digital-only banking also provides a superior customer experience by assessing customer needs using geo- and social-related insights. Digital-only banks are deserving not only for the value they provide to customers but also for the cost-effectiveness of their business strategy. Consumers may gain from the following benefits:

2. Robotic Process Automation – RPA:

“By 2025, increased labor productivity through robotic process automation could provide as much as 110 to 140 million full-time workers’ worth of output” – McKinsey.

A “robot” handles repetitive tasks such as:

- Data Entry

- Report Generation

- Financial Information Management

- Assessing The Solvency Of A Bank’s Client

- Handling Insurance Claims

- Addressing Customer Requests And Complaints

- Consumer Registration

RPA, which foresees 400% revenue growth for the FinTech sector by 2023, is the secret to its success.

This does not imply that the robots will take the place of the finance team. The labor-intensive financial operations are instead efficiently taken over by RPA, which functions as an unseen automated hand. This gives human resources a chance to breathe and concentrate on the activities that call for strategic thinking. The risks and threats posed by human error are also decreased, if not eliminated, by RPA’s speed and efficiency.

RPA essentially streamlines the core processes and functions of the finance business in addition to offering mundane tasks a high level of effectiveness.

3. Artificial Intelligence & Machine Learning:

Currently, banks all across the world are attempting to integrate AI into their daily operations.

As per the Autonomous research, AI will reduce 22% of the bank’s operational expenses by the year 2030. In other words, banks can save as much as $ 1 trillion by employing AI.

In the fintech industry, AI & ML deals with data for forecasting and decision-making. Fintech businesses continuously generate streams of statistics and data in reaction to market movements and the activity of millions of customers, not to mention numerous attempts at illicit conduct. It would be very challenging to manually keep track of the operations in such a situation and produce sufficient reports for such huge operating systems.

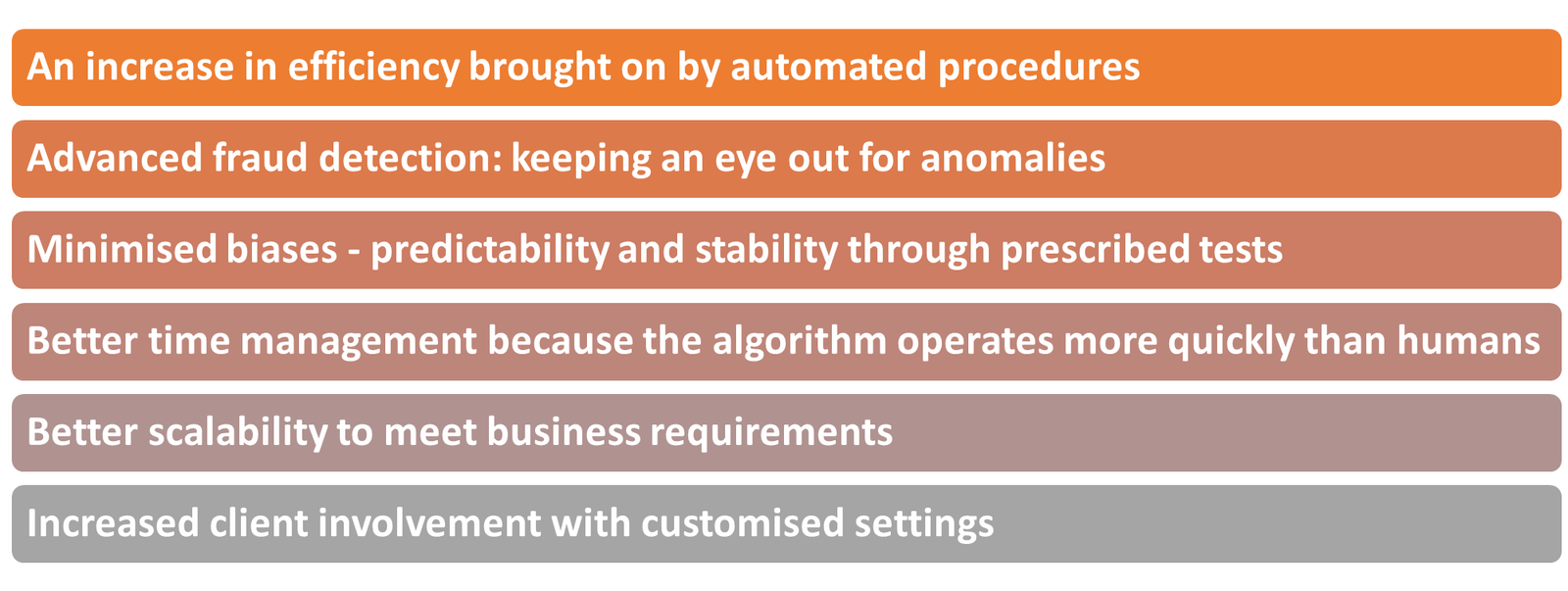

The following are some benefits of AI/ ML in FinTech:

4. Blockchain:

Blockchain has been defined as a digital ledger of records, or “blocks,” that are used to track assets and record transactions in a corporate network. It enables secure recording of data, making it nearly difficult to change or hack the system. One of the most appealing features of this technology is decentralized ownership, which is recognized to democratize processes while assuring security, transparency, and efficiency.

Approximately 48% of banking professionals believe that blockchain technology will have the biggest impact on banking in 2022 and beyond, according to a report by Business Insider Intelligence.

Blockchain-based business networks provide quick delivery of digital assets at lower prices, with more customization and sustainability. They provide the following benefits: Transparency, Security, Trust, Confidentiality, and Scalability.

5. Reg-Tech:

RegTech has emerged as a significant subset within the FinTech ecosystem as a result of intense pressure from regulators on overall data compliance and control. RegTech is the use of technology to manage regulatory procedures within the financial sector. Regtech’s primary tasks include monitoring, reporting, and compliance with regulatory requirements.

RegTech uses a variety of cutting-edge technologies, such as Artificial Intelligence, Big Data, Cloud Computing, Machine Learning, etc., to make sure businesses function successfully and efficiently to satisfy regulatory standards and compliance processes. RegTech is centered on reducing the likelihood of human error by turning manual processes into automated ones.

At its core, RegTech provides the wonderful potential to rebuild compliance, for instance by freeing up the workforce to do extra value-adding activities, lowering risks, gaining access to hidden insights, and ultimately saving enormous sums of money for companies.