FinTech in India

FinTech companies in India have been rapidly growing in the past decade. The fintech industry in India is currently worth $578 Bn and is expected to grow at a CAGR of 31% and reach $2.2 Tn by 2027. After United States and China, India has the world’s third largest fintech ecosystem. There are more than 120,000 fintech companies in the United States, and over 53,000 in India. The government’s initiative towards promoting digitization of financial systems and cashless economy has been pivotal in shifting consumer focus towards digital alternatives for financial transactions and services.

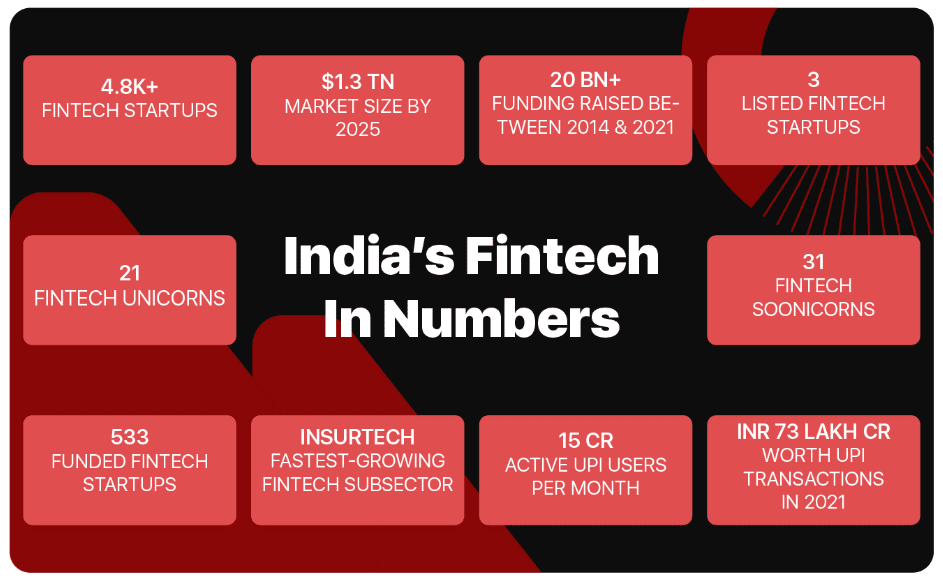

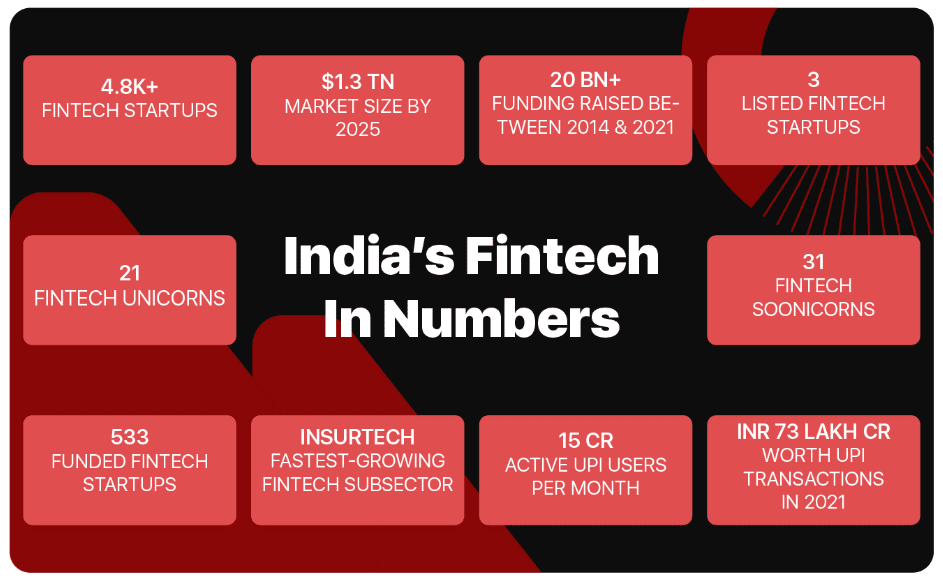

- With more than 5,000 Fintech start-ups, India is one of the fastest growing markets world-wide.

- India has the highest Fintech rate of adoption of globally.

Payments, Lending, WealthTech, InsurTech and Personal Finance Management are some of the sub segments of the Indian fintech industry.

India is becoming a hub for many fintech start-ups.

The top 10 Fintech players are:

- Paytm

- PhonePe

- MobiKwik

- PayU

- ETMoney

- PolicyBazaar

- Lendingkart

- Freecharge

- Mswipe

- Ezetap

Source: Inc42

Investments and the Industry Growth-Drivers

During the pandemic, the fintech industry thrived while every other sector saw a decline in growth, because COVID restrictions limited movement and favoured contactless transactions. India’s Unified Payments Interface (UPI) had 338 banks participating as of July 2022, and there were 5.9 billion monthly transactions totalling more than $130 billion.

In FY2022, the Indian fintech sector raised a funding of $8.53 Bn (in 278 deals). India has more than 20 fintech companies, that achieved ‘Unicorn Status’ with a valuation of over $1 Bn, as of July 2022. The following are among the top 30 fintech investors in India, who have each invested in an average of 23 deals:

- Sequoia

- Accel

- Tiger

- Global

- Y Combinator

Some of the main forces influencing the fintech revolution in India are supply side stimulants such as massively growing computing capabilities, widespread internet usage, combined with demand side facilitators like the need for inclusive financial services, customer expectations, and the businesses’ need to provide efficient and reliable services.

M&A Activity in FinTech

In 2022, the Indian start-up ecosystem saw 165 mergers and acquisitions, which is 126% more than during the same period a year prior. Out of these, the fintech sector accounted for 7.9% of the M&A activity. The increase in M&A activity in fintech, is due to the slowdown in the equity market caused by the Russian invasion of Ukraine.

This resulted in a reduction in funding across the world, including in India. Besides, the Indian government has been taking steps to regulate the emerging sectors and the start-up ecosystem, which has also made stakeholders risk averse. Start-ups are worried about a cash crunch in the near future due to the above reasons, and hence are leaning towards consolidation.

Companies are also acquiring to improve current technological capabilities. Neobank Open purchased Finin, a neobank, to upgrade its technology platform for online banking services. Some fintech companies use acquisitions to break into foreign markets. To increase its presence in South-east Asia, Pinelabs (which is planning an IPO) acquired Malaysian fintech start-up Fave.