“India is among the fastest growing fintech markets in the world with a market size of $31 billion in 2021 that is expected to reach $1 trillion by 2030” - V. Anantha Nageswaran, Chief Economic Advisor of India, Ministry of Finance, Government of India

Fintech brands are not only competing with the big, well-known brands of the traditional banks; they are also competing with one another in this increasingly crowded market. Mass market advertising is expensive, so large-scale customer acquisition carries a hefty price tag as well.

The best way for fintech companies to compete with traditional banks is to stand out in their customers’ eyes. Fintechs must accomplish this by focusing their marketing efforts on subgroups of potential customers who are more likely to be receptive to their products or services. In other words, they must segment the market in order to concentrate on fully addressing the needs of market subgroups.

Additionally, choosing more homogenous, smaller targets makes marketing easier to handle. With the marketing tools and budgets available, it is now possible to concentrate on targeting those specific customer segments more successfully. Once acquired, fintechs must make sure these clients are fully monetized and return frequently.

This is not to imply that mass-marketing will only be useful to a select group of fintech companies. Mass marketing would be appropriate when a fintech’s goods or services have broad appeal. Targeted marketing would be a better use of scarce resources for others, where the needs can only be satisfied within specific subgroups.

Finding the right customers, however, is one of the major problems the market is currently facing. After all, the “right” customer differs from a regular customer. The ideal client not only brings in lucrative business, but also encourages expansion through knowledge-sharing, recommendations, trial-and-error, and other advantages.

The ideal client does not always translate into the highest profits, though it is a factor. Furthermore, these clients are eager to explore the Fintech world because they are tired of traditional financial systems. They are prepared to speak candidly about their requirements and difficulties, as well as their goals.

The sales and marketing teams at the fintech company profit from these clients and their interactions. The drive to achieve the clients’ objectives and use technology to enhance their lives is also present. The relationship value between customers and the business is the main focus, and both parties mutually benefit from this relationship.

Fintechs can develop a detailed market segmentation based on the needs, attitudes, and behaviours of financial customers by combining quantitative and qualitative customer research approaches. Fintechs should create detailed profiles that include information on digital & media behaviours, financial product holdings, channel preferences, and purchasing triggers after identifying the most advantageous and desirable target segments.

In addition to the initial, early adopter target, a segmentation of this kind of market should, ideally, also identify second and third wave opportunities. Planning for messaging and media in the medium term would be based on this.

Before delving into the specifics of how to go about such a segmentation exercise, it is important to highlight some of the challenges that might arise:

- Verify that the market segmentation accurately predicts consumer behaviour.

- The strategy must be created to account for the possibility that customer attitudes expressed in research may be influenced by perceptions and biases, which increases the likelihood that the outcomes won’t accurately reflect actual behaviour.

- The strategy must account for customers’ potential lack of familiarity with ideas being created by fintechs (characterised by innovative or unconventional products or services).

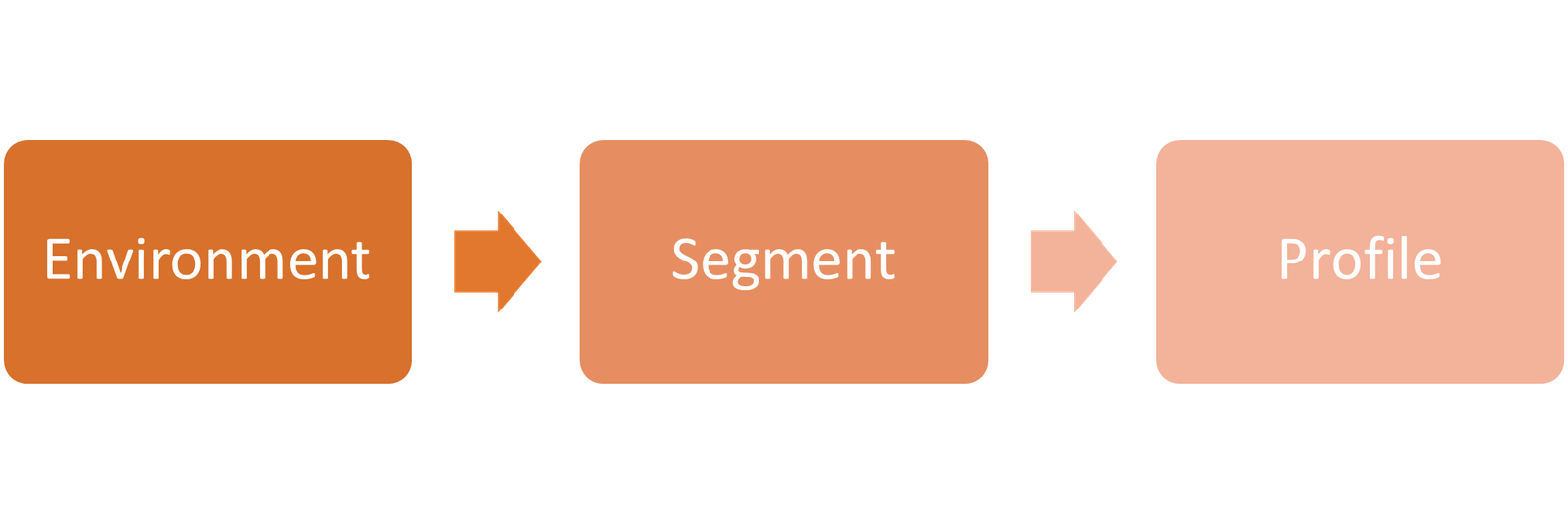

Fintechs should be able to handle these challenges with the help of a well-designed programme that adheres to the guidelines given below. An overview of the market segmentation strategy can be found below:

Source: YRSKMarketing

- Environment: Obtain insights and hypothesis to determine the segmentation’s dimensions.

- Segment: Quantitative research to create profiles and qualitative to give them life

- Profile: In-depth profiling of target segments to help in marketing & media planning

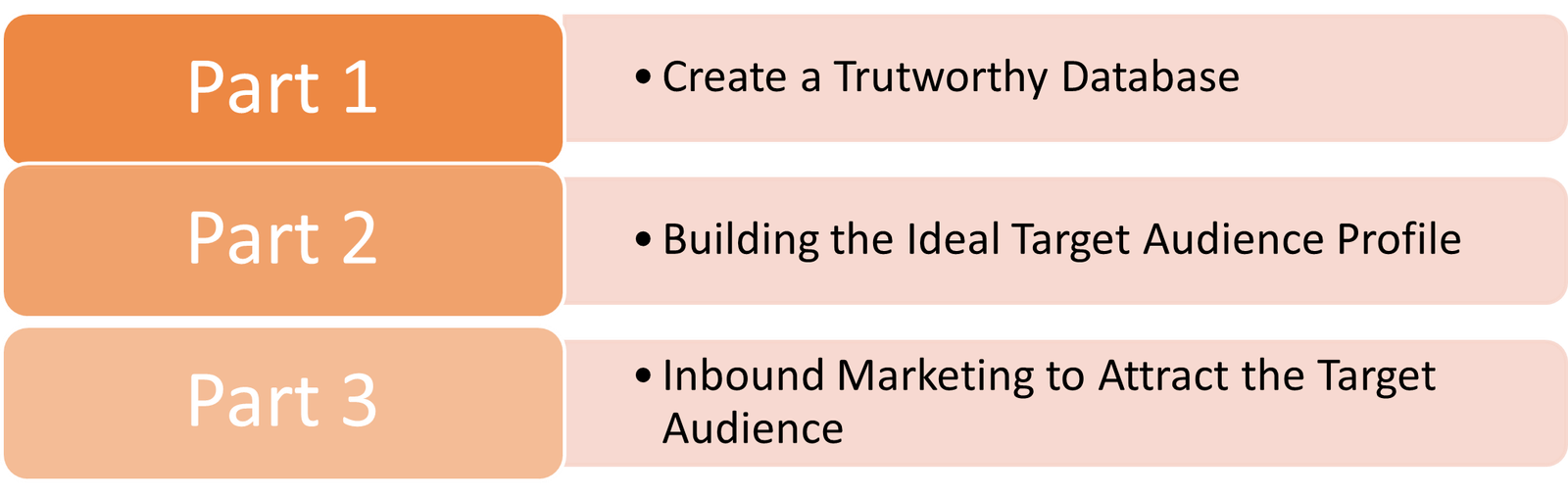

Steps in Identifying the Target Audience in Fintech:

-

Creating a Trustworthy Database

Knowing the subjective traits of the ideal customer and determining who they are objectively are two different things. The more important considerations that must be kept in mind are as follows:

- The Fintech company’s objectives

- The challenges to be addressed

- Details on the influencers and decision-makers (age, gender, location, profession, goals, education and financial background, interests, values, vendor-selection criteria, etc)

These data points must be obtained from credible sources. This can be discovered by consulting CRM data and engagement statistics from outside sources like social media and analytics tools. Another way is to ask customers and other significant stakeholders directly for this information. Indirect research can also be done to gather information for more accurate identification.

-

Building the Ideal Target Audience Profile

The next step is to begin creating a real-world image or profile of the perfect fit customer after determining the values of the parameters that are most important to this customer. It is first necessary to list the key characteristics of the fintech company, such as innovation, problem-solving, relationships, technology, etc.

It is necessary to define how each attribute should be perceived by the ideal target audience. For instance, when it comes to innovation, the ideal client might be willing to try out novel concepts and does not adhere to rigid conventions. After defining the rest of the attributes, the Fintech company will have a ready profile of the best potential target market that is worth the investment.

-

Inbound Marketing to Attract the Target Audience

The power of relevant and beneficial content is constantly increasing. Ideal customers can be drawn in by maximising the distribution and reach of this content through various channels. Inbound marketing is all about doing this. Compared to conventional paid marketing strategies, this type of marketing generates 54% more leads.

Inbound marketing is a more recent marketing idea. Inbound marketing is about the customer approaching the business, as opposed to outbound marketing, which places more emphasis on grabbing the customer’s attention. To engage and pique the interest of target audiences, inbound marketing

makes extensive use of a variety of content types. These consist of articles on blogs and social media, as well as infographics, email newsletters, e-guides, tests, and other materials. Other inbound marketing strategies that aid in the discovery and interaction of marketers’ content include paid search and native advertising. Data and insights are crucial for fintech companies as they work to improve customer acquisition. To personalise the process to the ideal target audience profile, a well-designed inbound marketing strategy will adopt a holistic approach.

- Determine which keywords are the most effective and are most likely to be used by the target audience.

- Incorporating popular topics into the inbound marketing content, by keeping an eye out for them.

- Creating content on crucial topics that are extremely relevant to customers, and what they expect from a Fintech company.

- Creating pillar pages that are thorough and of the highest calibre to draw customers to the content first and the business second.

- Incorporate CTAs into the content to indicate to the target audience that you have something important to say.

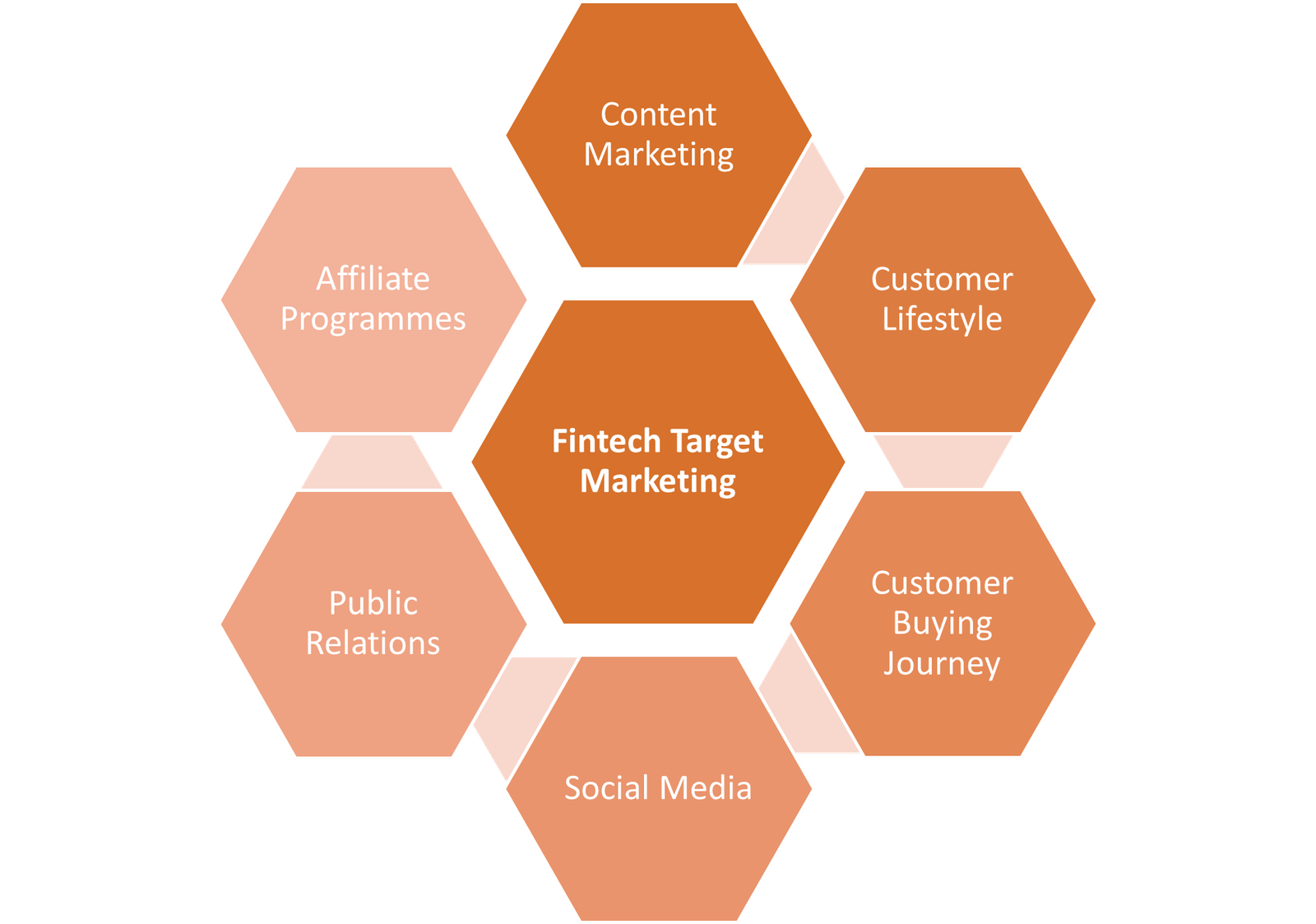

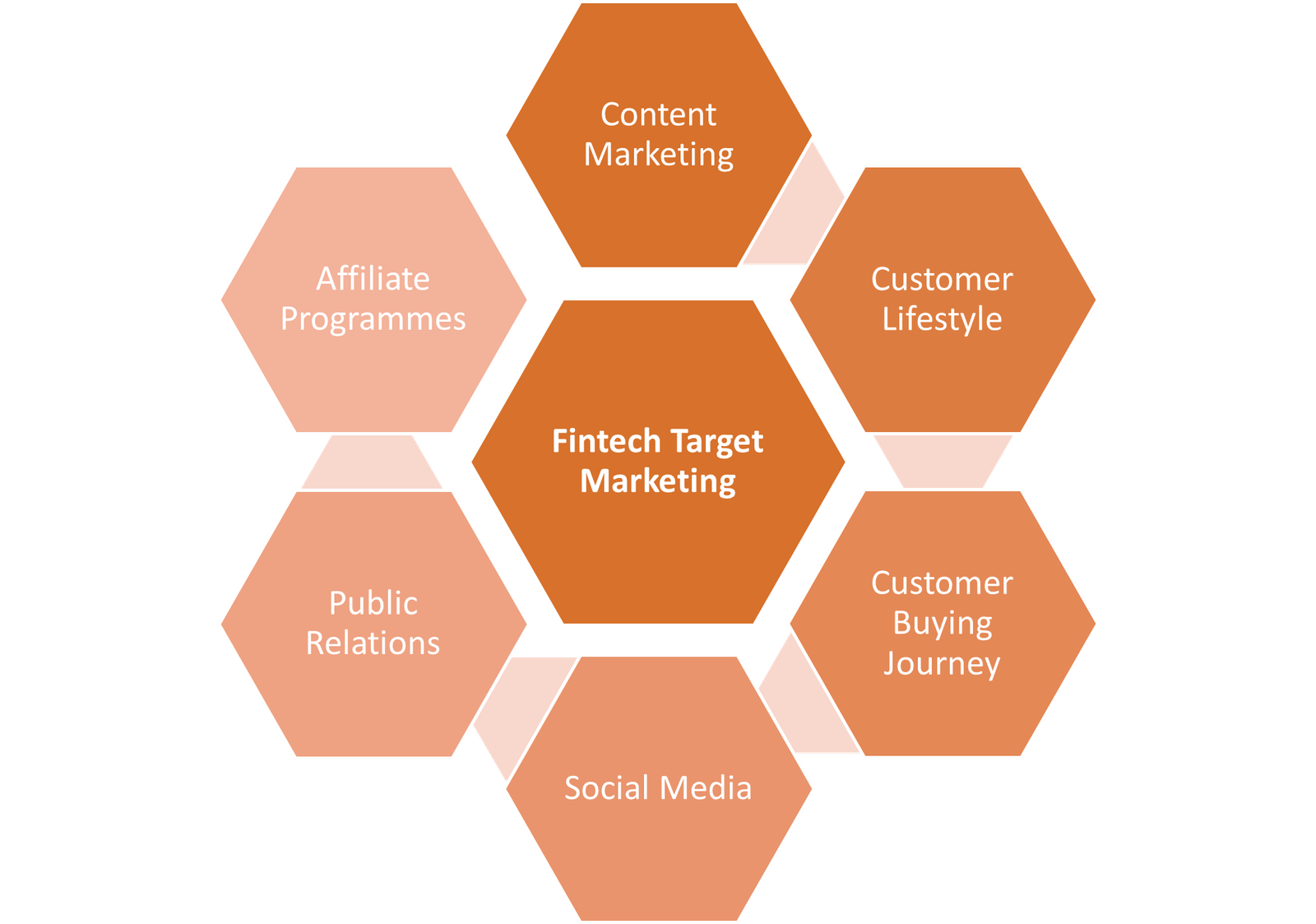

Source: FinExtra

In conclusion, fintech companies have a significant opportunity over the traditional banks in terms of innovation. Therefore, fintechs must:

- Segment the market.

- Optimise their product/ service and customer experience, according to the specific target segments.

- Promote the goods or services to the targeted groups.

- Build their brands amongst those specific segments.