AgriTech Overview

With Agritech being the buzzword among the investor community, and the Indian government going all in for supporting the Agritech industry, how is the startup ecosystem trying to solve the plight of the farmers? How do different verticals of the industry complement each other and come together to grow Indian agriculture?

Every discovery or scientific invention gets its root from the difficulties faced by humankind over time. That also stands true for all the Smart farming techniques and automation in the agriculture sector. For years, farmers in India have been distressed due to:

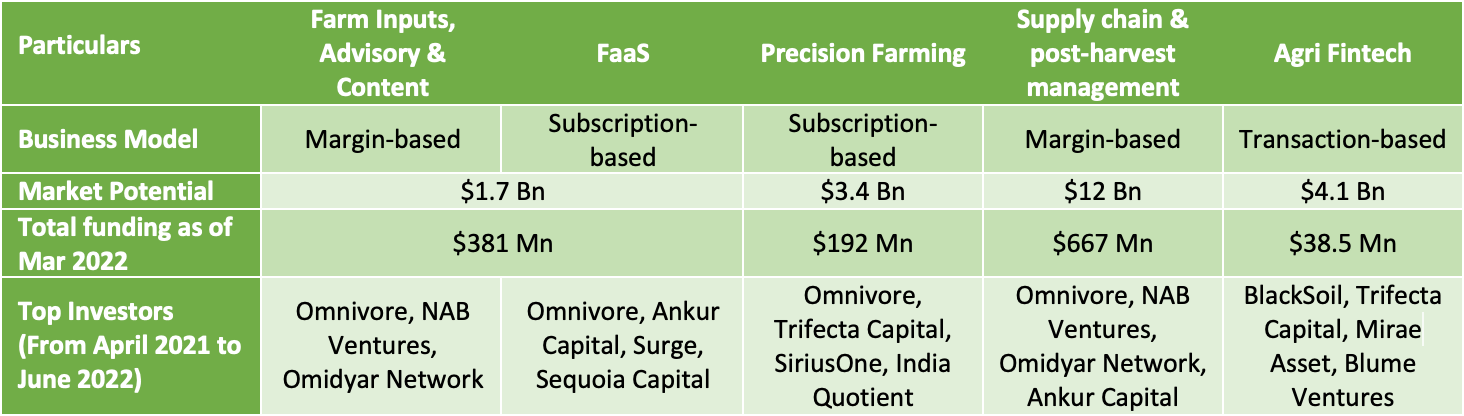

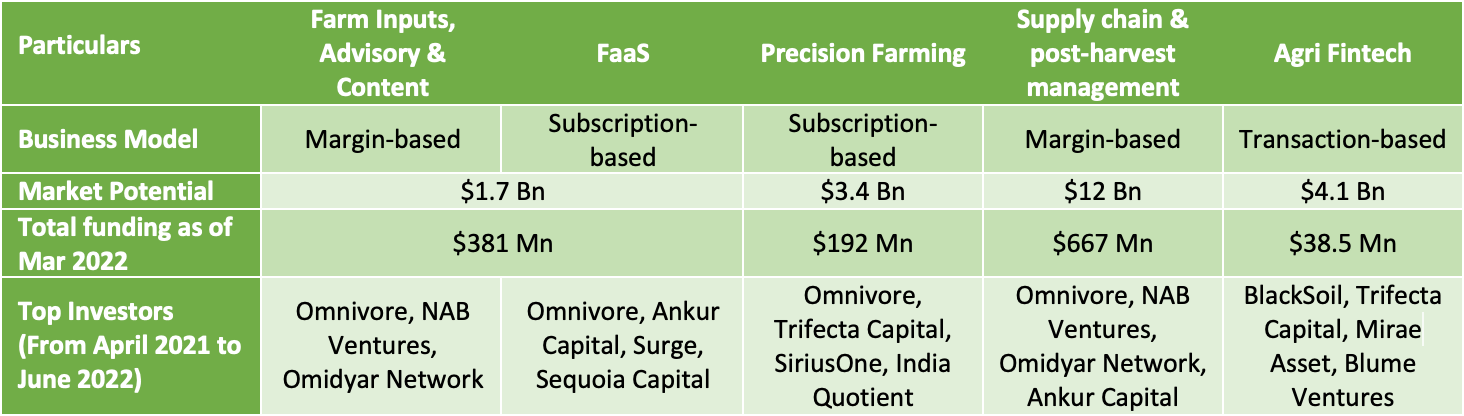

Being home to more than 1000 Agritech startups, India’s growth in the Agritech industry has been phenomenal in the last few years. The Year-on-Year funding in the space has increased from $155 Mn in 2020 to $636 Mn in 2021 and $539 Mn in H1 2022.

Farm Inputs, Advisory, and Content

Quality and affordable farm inputs like seeds, fertilizers, and pesticides are a huge concern for farmers. There are many instances of fake agricultural inputs from unorganized players, lack of credit facility to purchase the inputs, higher costs than the market price, and exorbitant interest rates for the credit period if credit is available.

The companies in this segment offer farmers an Online marketplace to buy farm inputs and farming equipment at the right prices, including credit facilities. In some cases, these companies collaborate with the Banks/NBFCs or Agri Fintech companies, which are backed by Banks/NBFCs to offer credit to the farmers. Evidencing demand for the farm outputs also improves the creditworthiness of the farmers and gives them access to quality inputs.

Along with inputs, these companies also provide farmers and FPOs with advisory on increasing productivity, usage of fertilizers/pesticides, soil nutrition, etc., through a missed call or having call centers. This information is provided based on the data collected by various institutions and companies in the precision farming segment, using advanced technologies like AI, ML, IoT, and more.

Farming as a Service (FaaS)

The solutions could be:

Precision Farming

To gather these data, companies use tools and technologies such as Sensors, Drones, Satellite imagery, GPS, GIS, and IoT devices, and the data is then deciphered to understandable information using AI, ML, and Data analytics to enable farmers and other stakeholders to make actionable decisions. The data not only help farmers in optimizing their farms but also helps them prove the efficiency of their land and water availability to those who are procuring the output, Agri Fintech companies, or NBFCs.

Precision farming tools are widely used to optimize water flow, and pressure and improve water efficiency, regulate the soil Ph, and regulate fertilizer/pesticide usage.

Supply chain, Post-harvest management, and Output Linkage

Therefore, the Agritech companies in this space bring efficiency in procurement through collection centers, cold storage facilities, cold chain connectivity, transfer, and delivery of products through technology and analytics. This is done by offering marketplaces for farmers to sell their produce at real-time prices to wholesalers and retailers (e-mandi), providing platforms to connect logistics and storage providers to farmers, and efficiently handling trucks to avoid partial loads.

Inadequate infrastructure in rural areas and lack of traceability of food products are the drivers of this segment and according to Inc42 and EY, it is the segment with the highest market potential.

Agri Fintech

Only 30% of the farmers have access to formal credit and the rest depends on informal credit with interest ranging from 24% to 60% against 7% charged by the PSU banks. The WACC for an average farm in India (about a hectare) is over 20%.

Data relating to Crop health, soil nutrients, quality of produce, etc., captured by the precision farming companies and technologies such as Geo-tagging, and remote crop monitoring can help build the risk profile of farms and farmers making lending by the Agritech companies easier. Warehouse receipts offered by post-harvest management companies and confirmed purchase orders from buyers can also serve the purpose of collateral for loans. A digital layer in addition to the physical infrastructure to digitize stock arrival, weighing, and quality assessment at warehouses can eliminate the need for physical verification while sanctioning loans.

Conclusion

Indian Agritech market is expected to reach $ 24 Bn in 2025 from $ 204 Mn in 2020 with Internet penetration, and Smartphone penetration being the tailwinds of the industry. The companies in the space can unleash their potential by entering strategic partnerships with service providers from different segments as they all are interdependent in solving the farmers’ problems. In fact, many companies like DeHaat, and Ninjacart have started the Farm to Fork business model offering all the services from providing farm inputs to delivering the products to the end consumers.